25+ Mortgage ratio calculator

Use our free mortgage calculator to estimate your monthly mortgage payments. View a 125000 loan amortized over 25 years.

3

View a 100000 loan amortized over 25 years.

. You can calculate the monthly payment including PMI by entering your details into our Mortgage Calculator. A front-end ratio is calculated by taking the full mortgage payment and dividing it by your gross monthly income. Top-Rated Mortgages for 2022.

For example if a borrowers mortgage payment including. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Were not including additional liabilities in estimating the income.

Paying a 25 higher down payment would save you 8916. Have made 300 monthly 12x. Account for interest rates and break down payments in an easy to use amortization schedule.

These qualities include debt-to-income ratios below a. View a 150000 loan amortized over 25 years. Rates are At a 40-year Low.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. To calculate the LTV ratio divide 150000 by 200000. Loan Amount and Rate Factors.

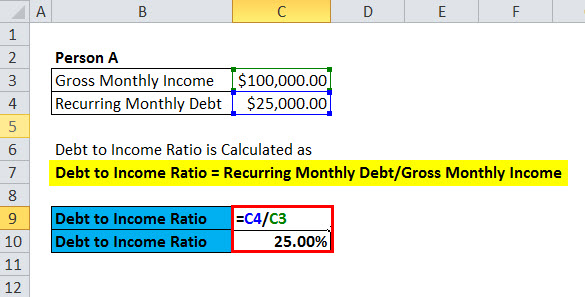

If your down payment is under 20 of the purchase price you will need mortgage insurance on your loan. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or.

Ad Compare The Best Mortgage Rates. So mortgage debt to income ratio monthly debt payment gross monthly income 750030000 100 25 which is well within the standard DTI ratio. To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments child support.

Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you. Find A Great Lender Today. In the fourth quarter of 2020 a tiny 016 of gross advances went to loans with an LTV over.

Its Never Been A More Affordable Time To Open A Mortgage. Calculate Your Home Loan. Over the 25-year amortization period you will.

A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694. Calculate your mortgage payment schedule and how to save money by making prepayments. Estimate a low and high range of PMI payments.

In this example the LTV ratio is 75. Use SmartAssets free mortgage calculator to estimate your monthly mortgage payments including PMI homeowners insurance taxes interest and more. We will determine the size of this premium and automatically include it.

To calculate how much house you can afford use the 25 rulenever spend more than 25 of your monthly take-home pay after tax on monthly mortgage payments. Use a mortgage calculator. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

This ratio helps your lender. Build Your Future With a Firm that has 85 Years of Investment Experience. What is a Debt-to-Income Ratio.

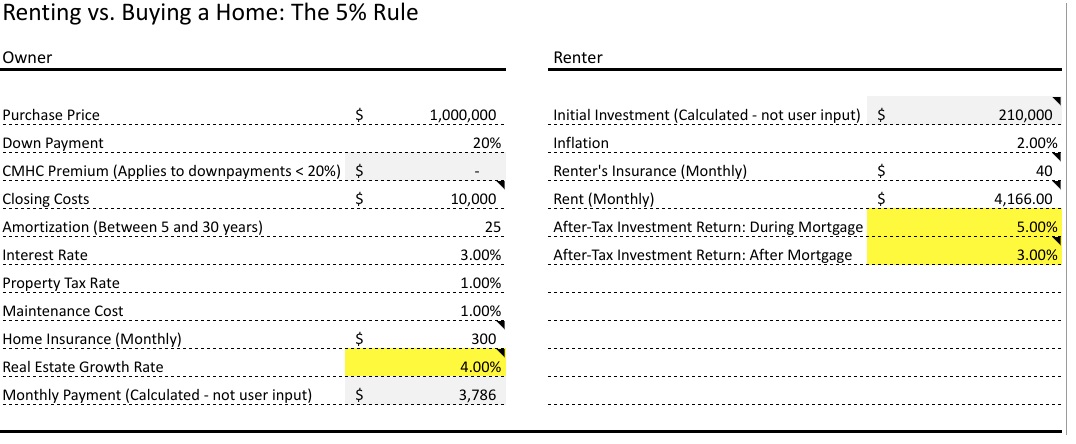

Rent Vs Buy Calculator The Devil S In The Details Toronto Realty Blog

Is It True I Never Thought About It R Latestagecapitalism

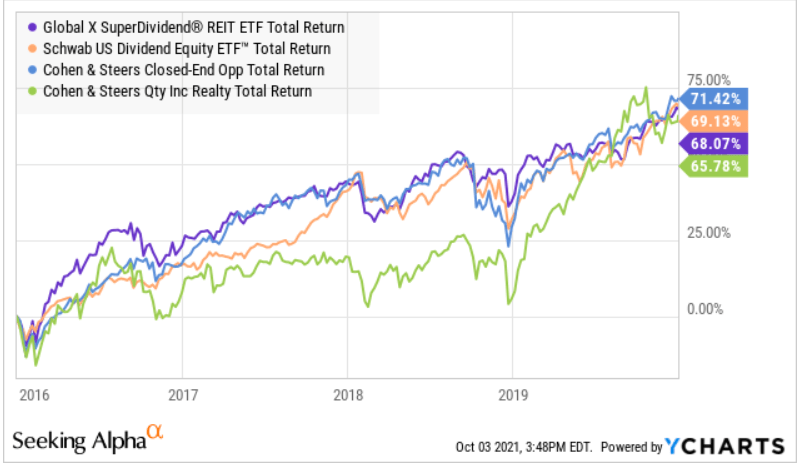

My Dividend Growth Portfolio Q3 Update 30 Holdings 11 Buys And 2 Sells Seeking Alpha

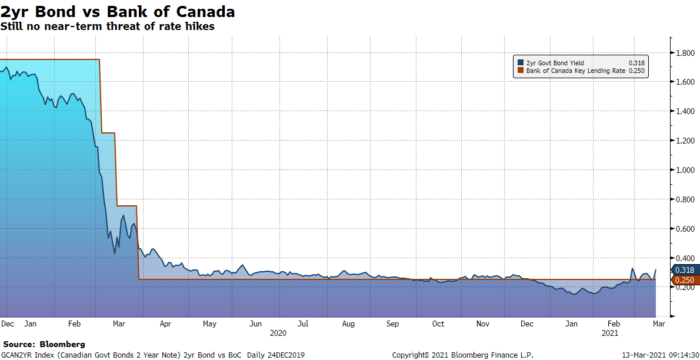

How Interest Rates Can Impact Your Monthly Housing Payments Mortgage Loans Mortgage Calculator Reverse Mortgage

What Comes After A Seller Accepts Your Offer Infographic Real Estate Infographic Real Estate Tips Real Estate Marketing

Fixed Mortgage Rates Highest Since August Ratespy Com

1

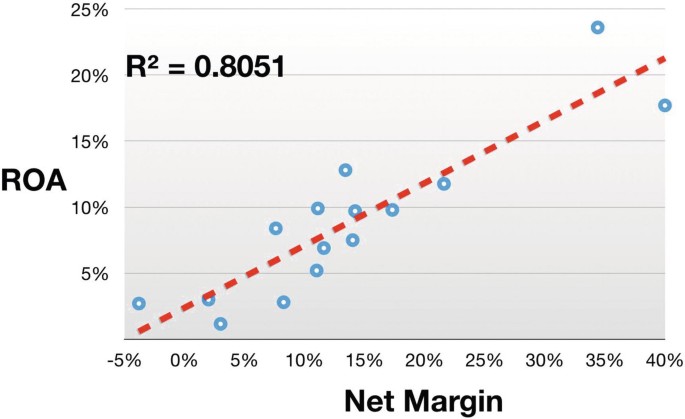

Valuation Ratios Springerlink

Debt To Income Ratio Formula Calculator Excel Template

End Of Qe 4 Fed S Repos Drop Below Oct 2 Level T Bills Balloon Mbs Fall Total Assets Down To Dec 25 Level Wolf Street

Recession Watch This Labor Market Is Not There Yet Nor Are Consumers Wolf Street

Recession Watch This Labor Market Is Not There Yet Nor Are Consumers Wolf Street

1

Recession Watch This Labor Market Is Not There Yet Nor Are Consumers Wolf Street

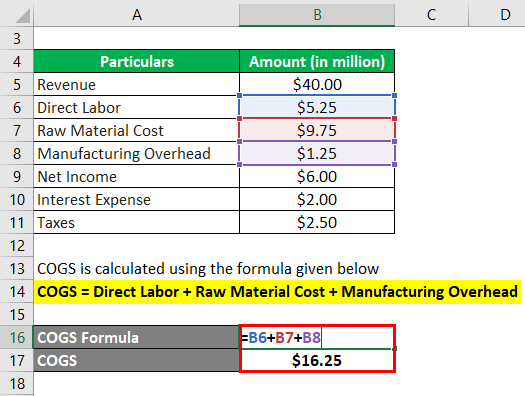

Operating Expense Formula Calculator Examples With Excel Template

The Dividend Growth Model What Is It And How Do I Use It

1